Portland General Electric stock downgraded

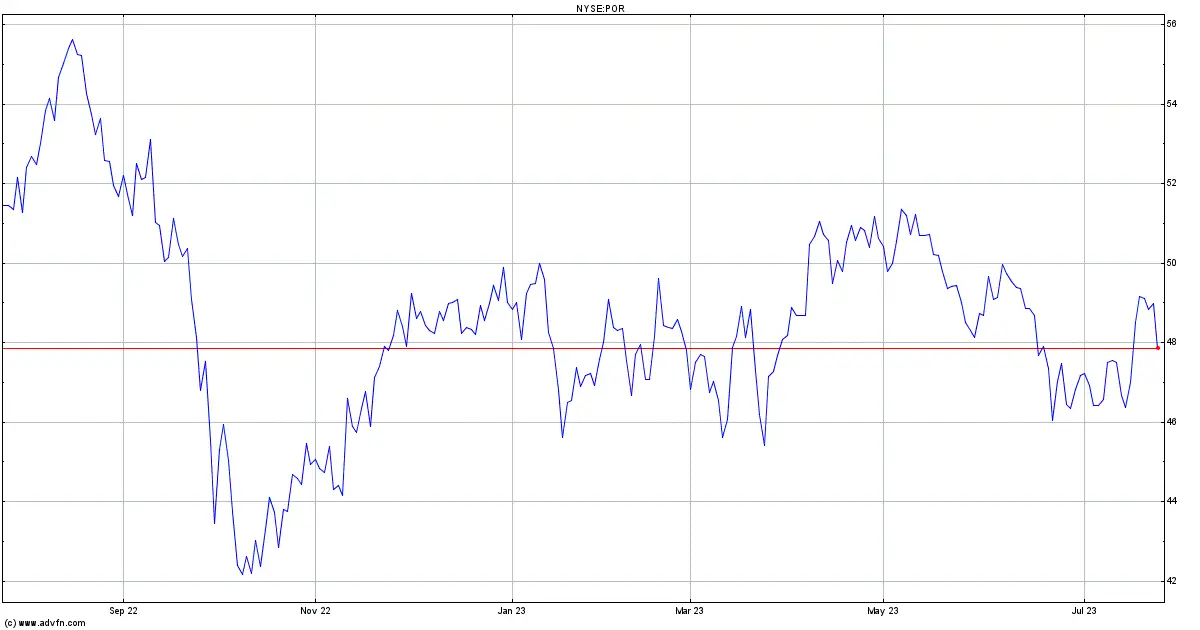

In a research report delivered to investors on Tuesday, StockNews.com has downgraded the rating of Portland General Electric (NYSE: POR – Free Report) from a hold to a sell rating.

Several other analysts in the equities research field have also recently issued their reports on POR. On Tuesday, June 20th, 58.com reaffirmed a downgrade rating on Portland General Electric shares. On Friday, July 7th, Guggenheim lowered their price target for the company from $50.00 to $48.00 in a research note. In a research note on Monday, May 8th, JPMorgan Chase & Co. initiated coverage on Portland General Electric, assigning an overweight rating and a $56.00 price target. Lastly, on Thursday, June 22nd, Bank of America revised its price objective for Portland General Electric from $56.00 to $52.00.

In summary, one analyst has rated the stock as a sell, four have issued a hold rating, and two have given a buy rating for the company. According to MarketBeat.com, the consensus among analysts is a Hold rating, with an average price target of $50.83 for Portland General Electric.

Portland General Electric Company is a fully-integrated electric utility enterprise operating in Oregon. Its business activities encompass electricity generation, wholesale power procurement, transmission, distribution, and retail electricity sales within the state. The company maintains a diverse portfolio of power generation assets, including six thermal plants, three wind farms, and seven hydroelectric facilities.

As of December 31, 2022, Portland General Electric Company owned an electric transmission system spanning 1,255 circuit miles. This system includes 269 circuit miles of 500 kilovolt lines, 413 circuit miles of 230 kilovolt lines, and 573 miles of 115 kilovolt lines. Through this extensive transmission network, the company serves a substantial customer base, catering to approximately 926 thousand retail customers across 51 different cities in Oregon.